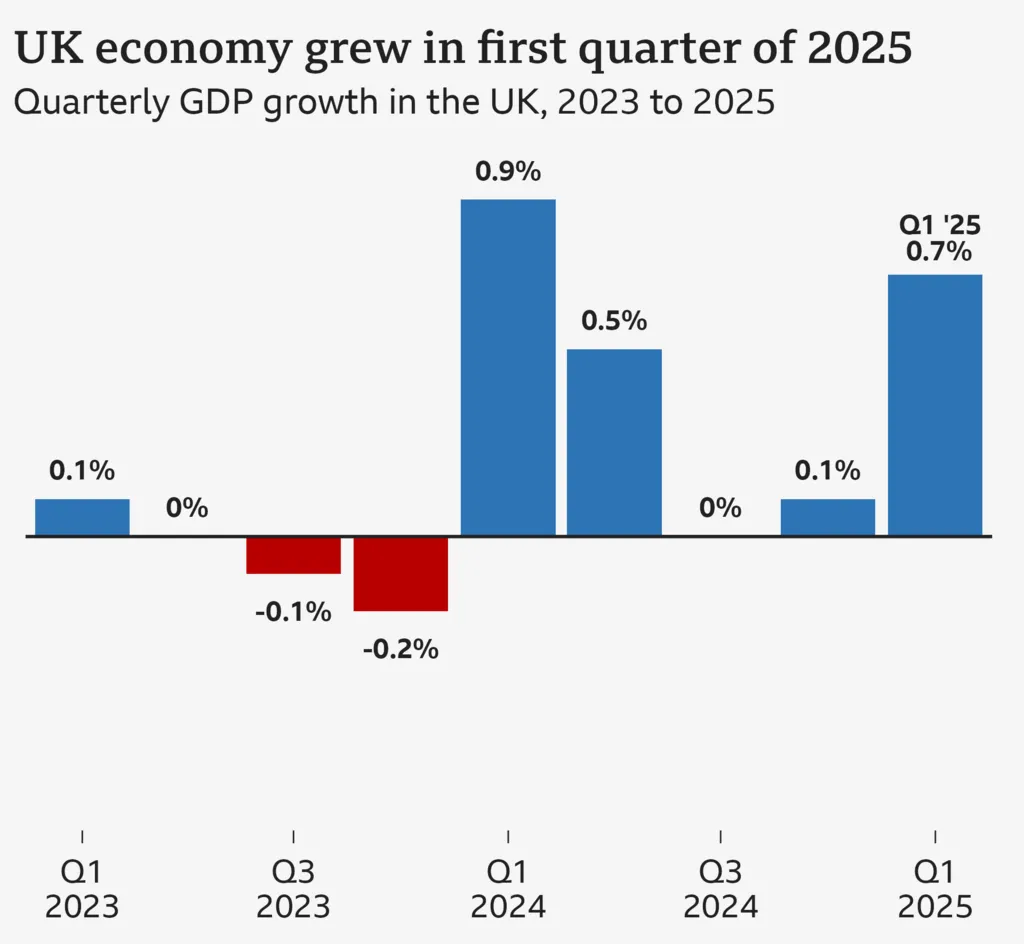

UK Economic Recovery Faces Mixed Challenges

When the Labour government came to power last year, boosting the economy was its top priority. However, its decision to raise employers’ National Insurance (NI) contributions faced criticism from many businesses. They argued this increase could slow down economic growth. Additionally, U.S. import tariffs threatened to impact the recovery. The International Monetary Fund recently downgraded its forecasts for both the global economy and the UK. Last week, the UK Economic Recovery and reached an agreement with the U.S. to reduce or remove tariffs on some British exports. Despite this, a general 10% tariff still applies to most goods entering the U.S. market.

Strong Growth Signals UK Economic Recovery

Rachel Reeves told the BBC, “We are set to be the fastest-growing economy in the G7 during the first quarter of this year.” She acknowledged that there is still work to be done, especially as many families continue to face the cost of living crisis. Still, Reeves emphasized that recent data shows the economy is beginning to turn a corner.

Meanwhile, some critics remain skeptical. Mel Stride, a Conservative MP, called the rise in employers’ NI a “jobs tax” and warned that Labour’s decisions might threaten the UK’s previous economic progress. Other political figures like Liberal Democrat Daisy Cooper praised the positive data but urged caution against complacency. Reform UK’s Richard Tice also predicted that the impact of April’s tax rises would soon be felt and could harm growth.

Service Sector Drives Growth Amid Uncertainty

The Office for National Statistics (ONS) reported that the services sector—covering retail, hospitality, and finance—was the primary driver of growth in early 2025. Real GDP per person also increased by 0.5%, recovering from declines in the previous two quarters.

However, experts warn that growth may slow down soon. Paul Dales of Capital Economics said the recent strong figures might be “as good as it gets” for the year, as some economic activity was brought forward ahead of the tariff changes and tax hikes. Export volumes rose by 3.5% after three quarters of decline, showing some positive signs.

HSBC’s senior economist Liz Martins noted that business investment increased nearly 6%, and the service sector remains robust. She said growth is not just from manufacturers rushing to beat tariffs but is more broadly based.

Business Reactions to Tariffs and Taxes

Scottish whisky distillery CEO Annabel Thomas expressed cautious optimism about the UK’s prospects. Her company is absorbing U.S. tariffs to keep prices stable and expand business in the U.S. market. Lower interest rates in the UK are also expected to boost consumers’ spending power.

Conversely, John Inglis, founder of diamond tool maker Exactaform, described the current business environment as uncertain. With tariffs eating into margins, he said making future investment decisions has become very difficult. Despite the temptation to move production to the U.S., Inglis wants to protect UK jobs and avoid layoffs.

Regarding the rise in employers’ NI, Inglis said while he accepts paying more, the extra cost chips away at profits needed for business expansion. “We’re holding fire on decisions,” he said, “because if you make the wrong one now, people lose their jobs.”

Interest Rate Cuts and Mortgage Market Outlook

Last week, the Bank of England reduced UK interest rates from 4.5% to 4.25%, signaling possible further cuts in the coming months. However, the stronger-than-expected economic growth has tempered expectations for additional rate cuts this year.

Analysts now predict fewer interest rate reductions than previously thought, which has influenced swap rates—key factors in fixed mortgage pricing. As a result, mortgage rates might rise again soon. For example, TSB has already announced an increase in its rates effective this Friday.