Markets Rally as US-China Tariff Deal Sparks Optimism

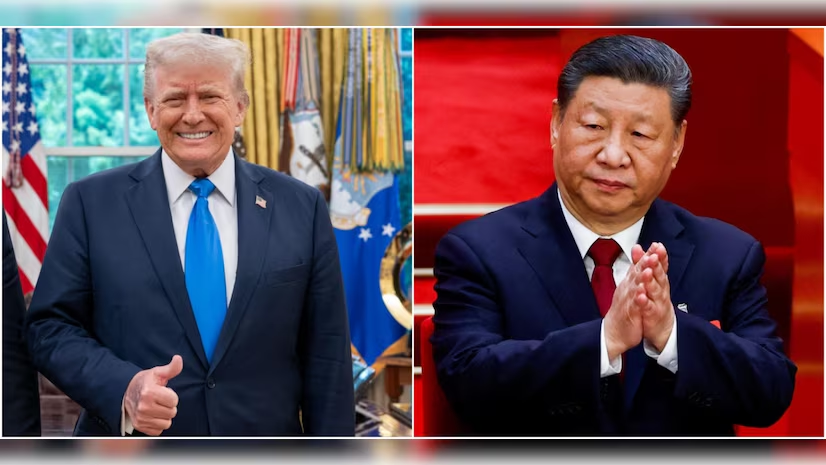

Global markets surged on Monday after President Trump revealed that trade talks with China over the weekend had led to a “total reset” in their economic relations, easing tensions in a prolonged and damaging trade standoff.

US-China Talks Lead to Major Tariff Cuts

High-level discussions in Switzerland resulted in dramatic reductions to the tit-for-tat tariffs imposed over the past month. The US will lower tariffs on Chinese goods from 145% to 30%, while China will cut its duties on US imports from 125% to 10%.

Although some levies have been paused rather than removed, President Trump said he doesn’t foresee US tariffs returning to their previous highs.

Trump: “We’re Not Trying to Hurt China”

In remarks following the announcement, Trump emphasized that the deal was aimed at de-escalation. He suggested China was under severe economic strain from the tariffs, facing factory shutdowns and social unrest. The president also said he expects to speak with Chinese President Xi Jinping later in the week.

US-China Tariff Rollback Fuels Market Gains

The de-escalation triggered a strong market response. The Dow Jones and S&P 500 rose more than 2.5% in early trading Monday, while the Nasdaq climbed 3.3%. Global indexes also moved higher, with Europe and Hong Kong seeing significant gains.

Shipping companies like Maersk and Hapag-Lloyd soared, while gold prices fell 3.1% as investors moved away from safe-haven assets.

US,China Agreement Suspends Most Retaliatory Tariffs

Under the new terms, both countries have agreed to suspend most of the tariffs imposed since April 2—referred to by the US administration as “Liberation Day.” All retaliatory tariffs beyond the 10% baseline have been cancelled for a 90-day period, and China has committed to removing certain non-tariff barriers.

However, the US is retaining an additional 20% tariff related to fentanyl enforcement, urging China to crack down on the flow of the synthetic opioid.

Broader Impact of the US,China Deal on Trade and Growth

The deal represents a clear shift in the direction of global trade relations. Scott Bessent, a US negotiator, said neither country wants a decoupling. “The excessive tariffs were acting as an embargo. Both sides want trade—balanced trade—and they are working to achieve it.”

China’s commerce ministry praised the agreement as a meaningful step toward resolving long-standing disputes.

Economists Warn of Lasting Effects Despite Progress

Experts welcomed the de-escalation but warned that higher costs from lingering tariffs will still affect American businesses and consumers. Neil Shearing of Capital Economics said trade will resume—but at a premium.

The IMF recently downgraded its global growth forecast, citing uncertainty caused by tariffs as a major risk to investment and supply chains.

US and China Relations Enter New Phase of Dialogue

In a joint statement, the US and China said they would create a mechanism for ongoing discussions on trade and economic relations, to be led by Scott Bessent and Vice Premier He Lifeng.

While major structural issues—like intellectual property protections, tech transfers, and subsidies—remain unresolved, both nations expressed hope that continued dialogue would help address these challenges.